Debt Collection

Affordable, Transparent Pricing with Flexible Payment Options

We provide a competitive, flat-fee structure for our services, with discounts available for clients requiring assistance with multiple issues. Payment plans are also available for added convenience. For debt collector concerns, our services start at $200.00, depending on factors such as the alleged outstanding balance, client requirements, and any necessary costs expected to be incurred.

Our comprehensive service includes:

- Document Collection – Gathering the essential documents to thoroughly assess your case.

- Case Evaluation – Conducting a detailed review of your documents to provide a clear, informed opinion tailored to your situation.

- Rights Advocacy – Supporting you in asserting your rights regarding debt collection and credit reporting issues.

- Settlement Assistance – Upon request, negotiating directly with lenders to pursue favorable settlement terms that align with your credit goals and reduce potential legal liabilities.

Our team is committed to delivering exceptional value with transparency, professionalism, and a focus on results.

Most Common Debt Collectors we fight against

Professional Debt Resolution Services for Credit Report Disputes

Many clients come to us after trying multiple credit repair services that, while somewhat effective with older debts, often struggle with persistent, larger debt collectors like Portfolio Recovery Associates LLC, LVNV Funding LLC, and Midland Credit Management Inc. Credit repair companies may manage to remove some minor or older items from credit reports, but when it comes to more significant debts, these large agencies typically respond promptly to disputes, making it difficult to achieve lasting results. Even after the account is removed from the credit report, many consumers report getting sued by a debt buyer or creditor.

The Ramos Law Firm’s Approach to Resolving Debt Collection Issues

Unlike traditional credit repair companies, our law firm directly engages with the debt collection firm or the debt owner reporting the negative item. Our team has built strong, enduring relationships with legal and compliance departments in leading debt collection agencies and debt buyers since 2003. These connections allow us to address credit issues more effectively and expedite resolutions for our clients.

Here’s an overview of our comprehensive approach to debt resolution:

- Document Acquisition and Review

We begin by obtaining all documents supporting the underlying debt, including verification of debt ownership and accurate records of debt activities. Our legal team carefully reviews these documents for discrepancies and any indications of errors or rights violations by the collection agency. - Customized Client Options

Every client has unique financial goals. After analyzing the debt documents, we provide tailored options based on each client’s specific needs and desired outcomes. While many clients aim to remove negative items from their credit reports, our firm explores various approaches that best align with each individual’s financial recovery plan. - Direct Engagement with Debt Collection Agencies

Leveraging our long-standing relationships, we negotiate directly with major debt buyers and collection firms, working with their legal teams to secure favorable outcomes. This direct approach, which emphasizes accuracy and accountability, sets us apart from traditional dispute-based credit repair methods.

Common Debt Collection Issues We Address

Our firm has identified several common issues in debt collection reporting that can negatively impact credit scores. We specialize in addressing these errors, helping clients achieve the most effective resolution possible.

1. Illegal Re-Aging of Debt

A common issue is the illegal “re-aging” of a debt, where the date of last activity is inaccurately reported on a credit report. When a debt is sold to a third-party debt buyer, this date is sometimes reset, making the debt appear more recent and thereby harming credit scores more than it should. We work directly with lenders to rectify these dates and, in some cases, secure removal of the negative tradeline altogether.

2. Lack of Proof or Right to Collect Debt

Many debt collectors lack the necessary documentation to verify that our clients owe a particular debt or even possess the legal right to collect it. In Texas, debt collection practices are governed by Texas Finance Code Section 392, which requires debt collectors to have full proof of debt ownership and legality. We demand validation of debt ownership and, when such proof is unavailable, pursue removal from the client’s credit report.

3. Misidentified Debtor or Wrong Party

Debt collectors often rely on skip-trace companies that may inaccurately associate debts with individuals who do not owe them. If our investigation finds that the debt has been mistakenly assigned to our client, we take immediate action to have the erroneous item removed from the credit report.

4. Identity Theft: Resolving Unauthorized Debts on Credit Reports

Identity theft can create significant and lasting damage to credit scores, often resulting in fraudulent debts and unauthorized accounts appearing on credit reports. At our firm, we address identity theft as part of a comprehensive debt resolution strategy that emphasizes accuracy and client protection.

Additional Services for Debt Collection and Credit Report Disputes

In addition to handling direct disputes with debt collectors, our firm offers a range of services designed to help clients recover from credit issues comprehensively:

- Negotiated Settlements and Payment Plans

For clients who aim to settle outstanding debts without credit repercussions, we work with collectors to negotiate settlements or set up payment plans that can prevent or remove negative marks on credit reports. Our attorneys ensure that all agreements are formally documented, providing clients with legal protection. - Credit Report Audits

We conduct in-depth audits of credit reports to identify errors and inconsistencies beyond those related to debt collection. Our audit services give clients a clearer picture of their credit standing and help eliminate reporting inaccuracies across the board. - Legal Defense for Debt Collection Lawsuits

If a debt collection agency has escalated an account to legal action, we provide robust legal representation to defend against lawsuits. Our team has extensive experience in debt defense and will work to reduce or dismiss alleged debts, protecting clients from further financial and legal complications. - Education and Financial Counseling

We believe in empowering our clients with knowledge and strategies to prevent future credit issues. Our firm offers educational resources and financial counseling, helping clients make informed decisions about their credit and debt management going forward.

Our process for all of our solutions includes:

- Investigative Support: We gather evidence to identify accounts, transactions, and debts that are being reported.

- Creditors and some times Direct Dispute with Credit Bureaus: We work directly with credit bureaus and creditors, presenting evidence of incorrect or fraudulent reporting demanding the removal or correction.

- Protection and Prevention: To help prevent further damage to your credit we can monitor your credit, we advise on security measures like fraud alerts and credit freezes as well as when new negative accounts appear.

- Ongoing Legal Support: In cases where incorrect reporting, other issues, or identity theft has led to lawsuits or aggressive collection actions, we provide legal defense and work to halt these efforts, protecting you from further financial harm.

By taking this thorough approach, we ensure that our clients’ credit reports are not only corrected but also safeguarded against future erroneous credit reporting.

Why Choose Our Law Firm for Debt Resolution and Credit Disputes?

When it comes to resolving credit report disputes and dealing with persistent debt collectors, the Ramos Law Firm stands out for its direct, personalized approach:

- Experienced Legal Team: Our attorneys have in-depth knowledge of Texas finance and debt collection laws, offering expertise that is invaluable for challenging unlawful practices and achieving favorable results.

- Industry Relationships: Our established relationships with major debt collectors allow us to navigate disputes more efficiently and secure timely outcomes for clients.

- Client-Centered Solutions: We treat each case as unique, creating solutions that align with each client’s financial goals and personal circumstances.

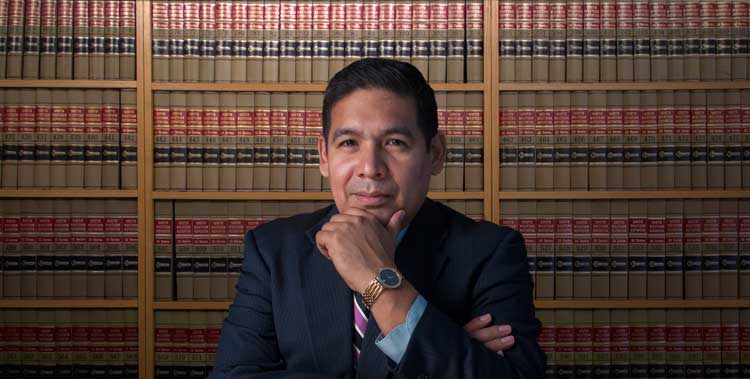

Guillermo Ramos, Esq.

Managing Attorney

Debt Collector FAQ’s

The duration varies depending on the complexity of the debt issue and the responsiveness of the debt collector. Our established industry relationships help us expedite many cases, providing clients with timely resolutions.

The Ramos Law firm offers a transparent fee structure tailored to each client’s needs. During your initial consultation, we’ll outline potential costs based on the complexity of your case and discuss affordable payment options.

Removing or correcting negative items often results in a credit score improvement. However, the impact varies based on the nature of the debt and other factors on your credit report. We provide guidance on expected outcomes based on each individual case.

We focus on debts that have reporting inaccuracies, lack of proof, or involve wrongful collection practices. While not every debt can be removed, our tailored approach ensures the best possible result for each client’s situation.

We request and review all debt documentation directly from the collection agency, verifying debt ownership and legality according to Texas Finance Code Section 392. If they lack proper documentation, we can demand removal of the debt from your credit report.

Yes, we assist many clients who have worked with credit repair services without satisfactory results. Our approach, which directly involves the debt owners and collection firms, often achieves more effective and lasting outcomes. We offer a complimentary phone consultation [Schedule Here] to discuss how we can best assist you.