Is it better to settle a debt with “Settled in Full” or “Paid in Full” notation on the credit report? During the credit repair process it is often necessary to settled a debt. Doing it the right way can help improve the credit scores and eliminate future problems.

What is the difference in “Settled in Full” or “Paid in Full”?

The Credit Reporting Agencies (CRA’s) like Experian, Equifax, and TransUnion can place entries on a credit report after a debt has been paid with the creditor or debt collector showing the accurate status of the acccount and how it was paid. Note that a debt collector does not have to change their entry monthly reflecting payments made on a payment plan. They can update the correct status at the end of a payment plan with the CRA’s once final payment is made.

“Settled in Full” – typically means that a consumer did not pay the full balance and settled the account. The creditor will show no balance on the credit report indicating that there is no more debt obligation. “Settled in Full” can also appear on a credit report as “Settled for less than full balance” or “Settled Accepted for less than full balance.”

“Paid in Full” – typically means that a consumer did pay the full balance and settled the account. The creditor will show no balance on the credit report indicating that there is no more debt obligation.

How does the paying a debt effect the credit score?

Whether “Settled in Full” or “Paid in Full” is shown on the credit report it has little effect on the credit score itself. The credit score weighs more heavily on whether a negative account is When the account was placed on the credit report and last updated, has a Balance, and the Rating of the Account

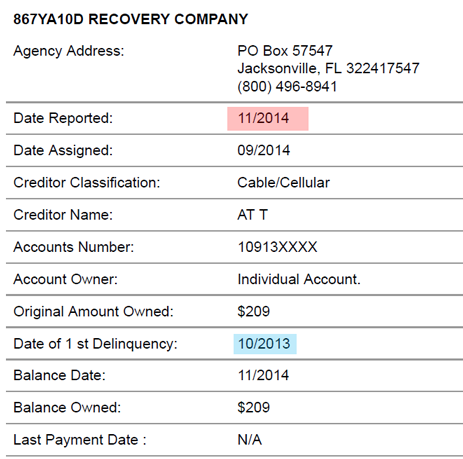

It is often misunderstood how and when to settle a debt for best credit score. To see if paying a past due collection will negatively impact your credit score, first look at When an item was placed on the credit report. If the account was last placed on the credit report in the last few months then paying it will have little impact on the credit score. If a negative account was placed on the credit report over 2 years ago then it could have a major impact lowering your credit score when payment is made. If the debt is older and you must settled the debt then time will heal the damage. Once a zero balance item is updated on the credit report for more than 24 months the score almost ignores it. It has little effect on a credit score.

When a negative account has a Balance reporting the credit scoring algorithm looks at it unfavorably because a consumer has not paid their alleged debts. Some consumers are forced to pay a debt to obtain a zero balance for a FHA and conventional mortgage. Again once paid and the zero balance is older than 24 months old then the credit score will tend to ignore the negative account. The Rating is the last important factor for how a paid account will reflect in the credit score. Most credit reports that consumers pull from the internet do not show the rating on the account as a Residential Mortgage credit report does. The rating system rates the account at various stages through the collection process. The #1 shows the account current and the the #9 shows that the account is in charge-off / Collections status. Most of the time when a debt is paid to the debt collector the balance is changed to zero balance and the rating is left as a #9. It would be helpful to the credit score to have the rating of the account changed to #1 or better. See below the Rating in light red.

New Court Ruling: How to get Debt Collectors and Creditors to show “Paid in Full?”

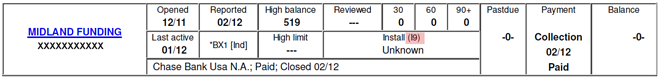

A new court ruling out of California may assist consumers in encouraging Debt Collectors and creditors to “paid in full” when they have actually paid for less than the full balance. In KIELTY v. Midland Credit Management, Inc., Dist. Court, SD California 2015, Midland Credit Management argued successfully that it had the right to show “Paid if Full” even if settled. The court agreed. Link to [ Kielty v. Midland Credit Management]

So when a consumer is on the phone discussing how a paid collection account is to show on the credit report after being paid they have more leverage in getting a ” Paid in Full ” reporting rather than settled.

If you have more questions about this “Paid if Full” and are a Texas consumer please call The Ramos Law Firm – Consumer Attorney (214) 556-2300 #1 or email cs@txclf.com. Outside of Texas you can contact the National Association of Consumer Credit Attorneys.

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]