Receiving a 1099-C form from the IRS can be confusing and concerning, especially if you’re unfamiliar with what it means. This form is issued when a creditor cancels or forgives a debt of $600 or more, and the IRS considers this canceled debt as taxable income. Here’s a guide to help you understand your options and navigate this situation.

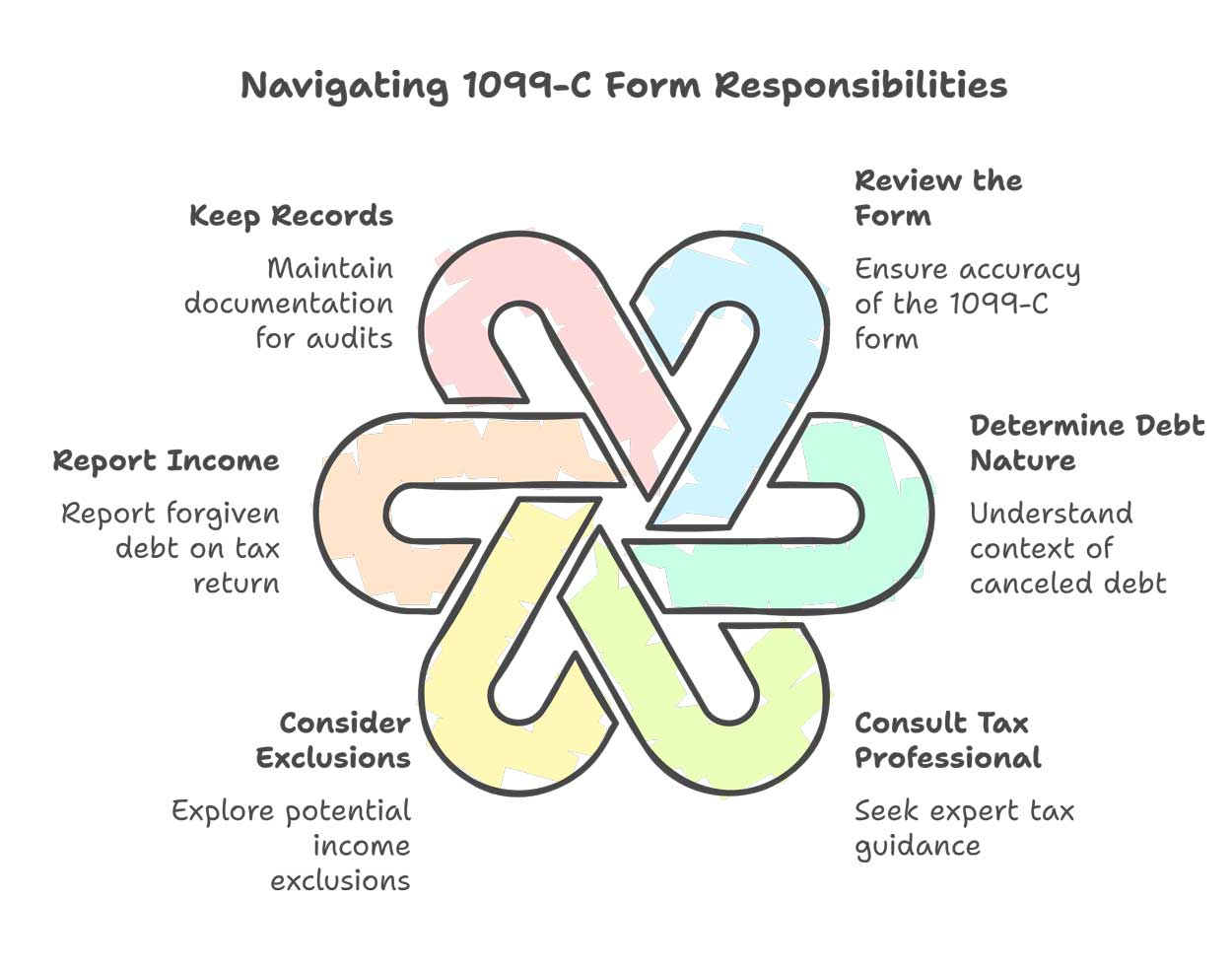

Step 1: Understand the 1099-C Form

The 1099-C, “Cancellation of Debt,” reports the amount of debt forgiven by a creditor. Common scenarios include canceled credit card balances, foreclosure deficiencies, or settled debts. The amount listed in Box 2 represents the debt forgiven, which the IRS typically treats as taxable income.

Step 2: Verify the Information

Before taking any action:

- Check for Errors: Confirm that the creditor’s name, the forgiven amount, and your personal information are correct.

- Ensure the Debt is Valid: If you believe the debt was never yours or was previously paid, contact the creditor immediately to resolve the discrepancy.

Step 3: Determine If You Qualify for Exclusions

Certain situations may exempt you from paying taxes on forgiven debt:

- Insolvency: If your total liabilities exceed your total assets at the time the debt was canceled, you may qualify for exclusion. File Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness, with your tax return.

- Bankruptcy: Debts discharged through bankruptcy are not taxable.

- Other Exemptions: Student loans forgiven under certain programs or qualified farm or business property may also be excluded.

Step 4: Report the Income

If no exclusion applies, you must report the forgiven debt as “Other Income” on your tax return. Include the 1099-C details to ensure compliance and avoid penalties.

Step 5: Seek Professional Assistance

The Ramos Law Firm can assist with resolving issues with 1099-C. Please contact us at (214) 556-2300.